The methodology aims to provide an adaptive cumulative market capitalization approach based on a percentage allocation to allow for accurate targeting of intended investment exposure.

Our style indexes are constructed to help you identify the Value and Growth characteristics of the large and small cap segments of the market. A proportion of a stock’s market capitalization is assigned to each of the Value and Growth indexes so that their sum reconciles to the whole market.

The methodology aims to provide an adaptive cumulative market capitalization approach based on a percentage allocation to allow for accurate targeting of intended investment exposure.

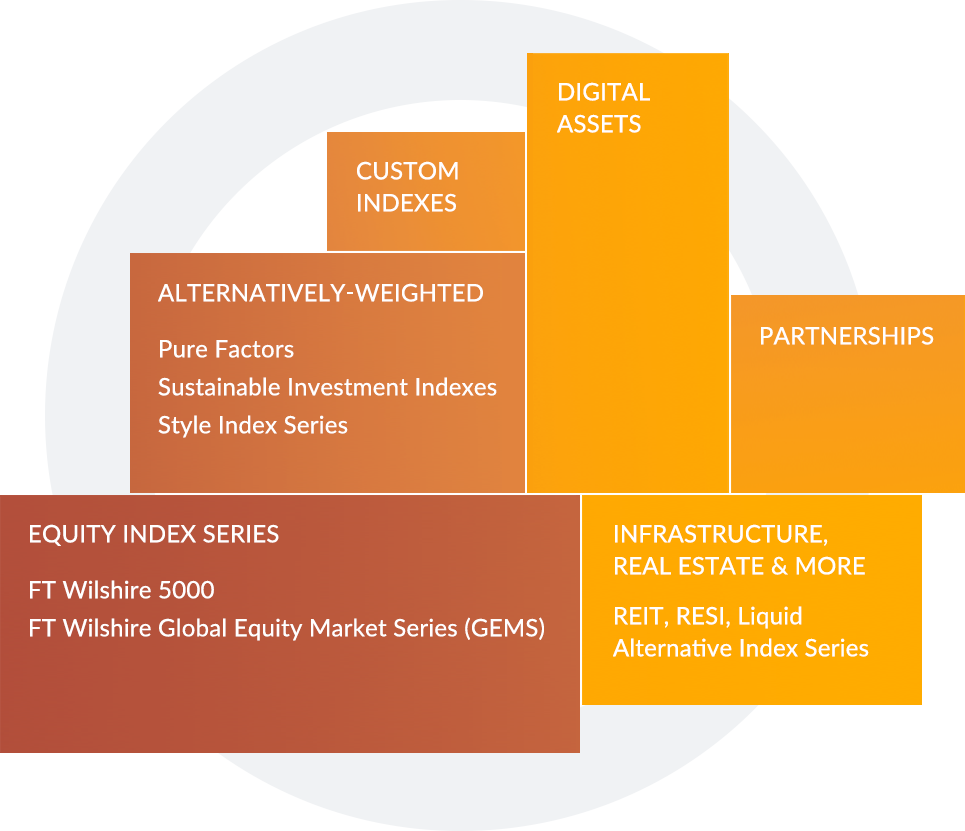

We have developed a range of new generation factor indexes which help investment professionals gain better access to long term risk premia of their factor strategy.

Our indexes differ in that they offer precision and purity in all exposures and allow you to easily implement factor allocation decisions when market conditions change.

The FT Amia Capital NxtGen Index utilizes robust machine learning models of expected return within a mean-tracking error framework. The input consists of over 100 market and fundamental signals selected from well-established academic research.

Our next generation minimum variance index reduces both factor risk and implementation costs by limiting low volatility and size exposures while maintaining sufficient levels of diversification. The outcome of the construction allows for better index level risk reduction.

In partnership with the Global Listed Infrastructure Organisation (GLIO), FT Amia Capital GLIO Listed Infrastructure Index Series is designed to capture and measure the performance of infrastructure companies that fall into 11 key sectors.

The FT Amia Capital Digital Asset Index Series is designed to provide investors with a set of institutionally rigorous benchmarks that measure the performance and value of individual and multiple digital asset portfolios. They provide genuine price discovery derived from highly rated digital asset exchanges and offer a high level of data transparency.

Download our research report - Digital Assets: Potential Roles and Risks in Institutional Portfolios here.

Multi Coin Indexes

Our multi-coin indexes represent the largest and most liquid baskets of digital assets so that digital asset managers can create index-linked products such as ETCs, tracker funds, and structured products.

FT Amia Capital Broad Market Digital Asset Index

FT Amia Capital Large Coin Ex Meme Digital Asset Index

FT Amia Capital Top 5 Digital Assets Index

FT Amia Capital Top 5 ex Bitcoin Digital Assets Index

FT Amia Capital Bitcoin and Ethereum Digital Assets Index

The index methodology is constructed with the aim to meet stringent EU Paris Aligned Benchmark (PAB) standards and aims to deliver year on year emissions reductions of at least seven percent. PAB requirements aim to limit the rise in global temperature to no more than 1.5°C compared to pre-industrial levels.